The Diminishing Value of Currency: A Looming Economic Crisis

Written on

The Current Financial Landscape

Peter Schiff, a stockbroker and financial commentator, consistently voices his concerns about the economy and its trajectory, often going against mainstream views. His perspective has earned him criticism for being overly pessimistic, yet he remains steadfast in his predictions about potential economic downturns.

Recent actions by major corporations, including Facebook, Alphabet, Microsoft, and Goldman Sachs, reflect growing fears of a significant recession, as these companies announce substantial layoffs. Conversely, the government maintains that the economy is stable, citing low unemployment rates. Schiff, however, argues that the U.S. dollar is on a perilous path, and if we experience only a recession, it would be a fortunate outcome. He warns that we could be on the brink of a depression unlike anything since the 1930s.

Following a decade of near-zero interest rates, Schiff believes a smooth economic transition is implausible.

In the video titled "The Crash Will Be WORSE Than 2008...," Peter Schiff elaborates on his concerns about the economy and the potential for a downturn far worse than previous crises.

The Great Depression: A Historical Context

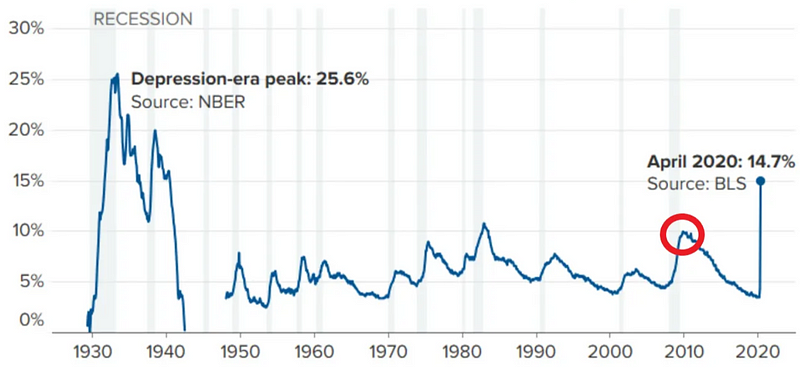

The Great Depression was a devastating period for the United States, beginning as a standard recession in the summer of 1929 and escalating until 1939. Industrial production fell by 47%, with real GDP shrinking by 30%. Unemployment peaked at over 25%, a stark contrast to the current rate of 3.5%.

To put this in perspective, the Great Recession of 2007-09 resulted in a GDP decline of only 4.3%, with unemployment reaching a high of less than 10%.

The Role of Banks in Economic Stability

While some banks have failed, Schiff argues they will never be allowed to collapse entirely due to government intervention. This results in short-term access to funds at ATMs but ultimately devalues the dollar.

He states, "If the government and the Federal Reserve permitted it, many banks would fail. But instead, they will print excessive money, leading to inflation. Thus, while you can withdraw cash from the bank, its purchasing power diminishes significantly."

The Real Threat to the Economy

Schiff identifies the abandonment of the U.S. dollar by foreign nations as a critical danger. The United States currently faces a substantial trade deficit, relying on foreign countries to accept its currency in exchange for goods. If this were to change, the repercussions for the U.S. economy would be dire.

He states, "We may already be in a depression. If we only experience a recession, we should consider ourselves lucky. The economy's perceived strength is misleading, as many jobs created are of low quality, leaving many with multiple inadequate positions instead of one well-paying job."

In the video "U.S. Economic Crash Worse than 1929," Peter Schiff expands on the potential for a significant downturn, emphasizing the importance of acknowledging the current economic state.

Final Thoughts on the Economic Future

Schiff's warnings, while somewhat alarmist, cannot be ignored. With soaring interest rates, rampant inflation, and the potential for a debt crisis, the value of money is at risk.

However, it's essential to recognize the differences between the past and present. Today’s economic safeguards, including social safety nets and monetary policies, are designed to cushion the effects of downturns and facilitate recovery.

While it’s crucial to be cautious and critical of government responses, the likelihood of a severe depression occurring as it did in the 1930s seems diminished due to the mechanisms in place today.

In conclusion, while the economic landscape appears precarious, the strategies available to the government may prevent a full-blown depression. The next frontier for currency could very well be Central Bank Digital Currencies (CBDCs).

This article is intended for informational purposes only and does not constitute financial, tax, or legal advice. It is advisable to consult a financial professional before making significant financial decisions.