Understanding the "Buy. Borrow. Die." Strategy for Wealth

Written on

Chapter 1: The Wealth Control Paradigm

It's often said that wealth is concentrated in the hands of a select few. In this article, we will explore how the affluent maintain their financial status and how these principles can be applied by anyone aiming to enhance their financial standing.

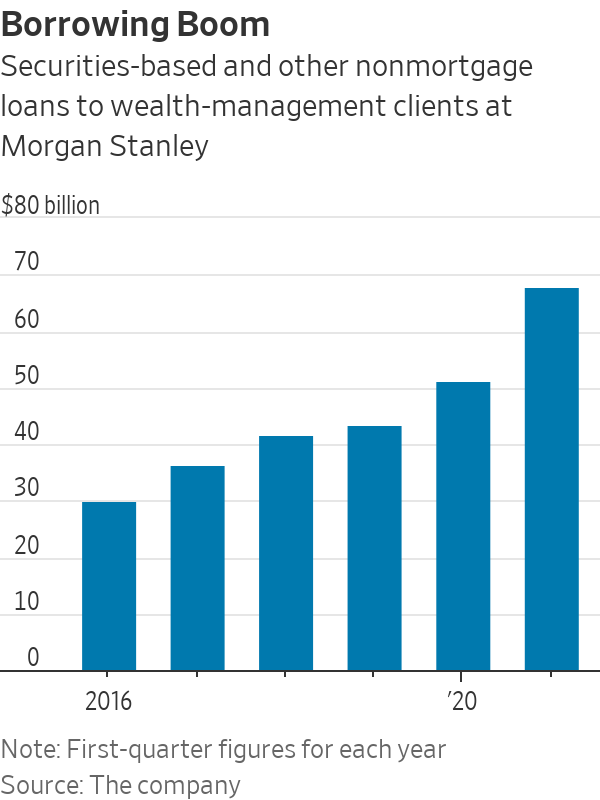

According to a report by Morgan Stanley, wealth management clients have accumulated $68.1 billion in security-based loans, a figure that has doubled since 2016. Similarly, Bank of America noted $62.4 billion in home equity loans. This raises an intriguing question: Why do wealthy individuals choose to borrow money?

If they are already affluent, why is borrowing necessary? The answer lies in a fascinating strategy that allows them to maintain their wealth without liquidating their assets. This approach is essential for the transfer of generational wealth and the establishment of powerful financial legacies. The good news is that anyone can apply this technique, regardless of their current financial status.

The strategy can be encapsulated in three straightforward steps: "Buy. Borrow. Die." Coined by Edward McCaffery, a tax law professor at the University of Southern California, this phrase illustrates how the rich navigate the American tax system.

The core concept is that wealthy individuals invest in assets, such as real estate or stocks, and instead of selling them, they borrow against these assets at low interest rates. Upon their passing, the estate is inherited by their heirs.

When I began my investment journey, my primary concern post-purchase was when to sell. Many new investors operate under the belief that they should hold onto assets for several years, selling them off for retirement. However, this is not the reality of wealth accumulation. This strategy encourages a mindset akin to that of the affluent.

Section 1.1: Asset Acquisition

The initial phase is often referred to as the accumulation phase in traditional finance. Common advice includes pursuing education, securing a well-paying job, saving diligently, and investing in assets. Most individuals spend their lives in this phase.

Let's delve into the various assets available for investment and their potential benefits. The three most popular asset types are real estate, stocks, and cryptocurrencies.

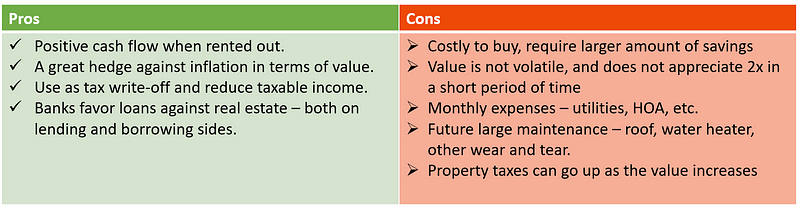

Real Estate:

For many, buying a home may not be the optimal investment due to additional expenses such as property taxes, insurance, and upkeep. However, employing this strategy can turn your home from a financial liability into an asset. Wealthy individuals, with net worths in the hundreds of millions, often borrow against their real estate, living tax-free while their properties generate income. They utilize a strategy called maximizing loan-to-value (LTV), allowing them to borrow against their assets without incurring capital gains taxes.

Pros and Cons:

Stocks:

My investment portfolio has grown to $25,000 in Robinhood since 2018, a taxable account. By adopting a wealthy mindset, I plan to hold these investments long-term, benefiting from dividends or borrowing against my holdings.

Cryptocurrency:

This same logic applies to my investments in cryptocurrencies like Bitcoin and Ethereum. I believe these assets will appreciate significantly over time, allowing me to borrow against them as well.

The key takeaway from this buying phase is that the wealthy do not sell; they accumulate. As noted by finance YouTuber Andrei Jikh, "Your first million is the hardest to achieve."

Step 2: Leveraging Assets

The next step is straightforward: borrow against the assets acquired in the first step.

Stocks:

This can be accomplished via a Securities-Backed Line of Credit (SBLOC), allowing investors to access a percentage of their portfolio's cash value at a low interest rate. If I need cash, I could borrow up to 35% of my portfolio's value at a low interest rate instead of liquidating my stocks.

Interest Rate Arbitrage:

Wealthy individuals capitalize on asset-backed loans with lower rates than the growth rate of their investments. For instance, if I invest $100,000 with a 10% return and borrow that amount at 2%, my additional earnings significantly outweigh the interest I owe.

However, it's crucial to note the risks involved. Market downturns can lead to margin calls, putting the investor's assets at risk. An example of this risk was the significant losses faced by Bill Hwang of Archegos Capital Management during the market crash in March 2021.

Real Estate:

A similar strategy involves a Home Equity Line of Credit (HELOC). If you have equity in your home, you can secure a low-interest loan using that equity, which can then be used to pay off higher-interest debts.

Cryptocurrency:

Investors can now borrow against their cryptocurrency holdings through platforms like BlockFi, which offer low rates and favorable terms. However, the inherent volatility of cryptocurrencies presents a significant risk.

Step 3: Transfer of Wealth

This step is straightforward but crucial for maintaining generational wealth. Upon death, your estate is passed on to beneficiaries. Any loans can be settled by selling the assets against which they were borrowed.

Many affluent families set up trusts to facilitate this process, allowing for the transfer of wealth at a stepped-up cost basis. For example, if a property bought for $1 million appreciates to $2.5 million, heirs can sell it without incurring capital gains taxes.

Key Takeaways:

You might wonder why everyone isn't utilizing these steps to accumulate wealth. The answer lies in individual financial circumstances. Before engaging in such strategies, it’s prudent to establish a solid financial foundation:

- Build an emergency fund covering 3-6 months of expenses.

- Contribute to your employer's 401(k) up to the company match.

- Max out your Roth IRA.

- Max out your 401(k).

- Open a taxable account for borrowing purposes.

Leverage can be a double-edged sword; use it judiciously based on your financial situation.

In conclusion, as Andrei Jikh aptly states, "Instead of hating the game, learn the rules, play the game, and love the game." Thank you for reading, and I hope this content aids you on your financial journey. If you found this helpful, please follow along for more investment and self-improvement insights.

Chapter 2: Video Insights on Wealth Strategies

The video titled "Buy. Borrow. Die. | How The Rich Stay Rich" explores the mechanics behind this wealth strategy and offers insights into how the wealthy maintain their financial status.

In "How To Avoid Taxes Like The Rich - Buy Borrow Die Strategy Explained," viewers can learn how to implement these strategies effectively to enhance their financial well-being.